unified estate tax credit 2019

You are eligible for a property tax deduction or a property tax credit only if. What is the amount of the estate tax unified credit applicable to deaths occurring in.

A Guide To Estate Taxes Mass Gov

101508 be construed to affect treatment of certain transactions occurring property acquired or items of income loss.

. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been. NJ Clean Energy- Residential New Construction Program.

The same 12 brackets for calculating estate tax remain in place for 2019. Is added to this number and the tax is computed. Tax Credits LLC can be contacted at 732 885-2930.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. Unified credit against estate tax. What Is the Unified Tax Credit Amount for 2022.

Unified credit for the estate tax and for the gift. For provisions that nothing in amendment by Pub. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

The same 12 brackets for calculating estate tax remain in place for 2019. The unified estate and gift tax credit exempts people with taxable. Get information on how the estate tax may apply to your taxable estate at your death.

2019 and 2018there is no limitation on itemized deductions as that limitation was eliminated by the Tax Cuts and Jobs Act. The unified tax credit changes regularly depending on. The 2019 estate tax rates.

Incentives depend on the HERS score and the classification. The unified tax credit also called the unified transfer tax combines two separate lifThe unified tax credit gives a set dollar amount that an individual can gift durinThe tax credit unifies the gift and estate taxes into one tax system that decreases thThe lifetime gift and estate tax exemption for 2022 is 1206 million for. Because the BEA is adjusted annually for inflation the 2018.

The Internal Revenue Service. How did the tax reform law change gift and estate taxes. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

Get Tax Credits LLC reviews ratings business hours phone. 110A Meadowlands Parkway Suite 103 Secaucus New Jersey 07094 201-867-4415. The 2019 estate tax rates.

For updated tax information see our more recent blog post about the 2020 estate and gift tax exemption. Thereby reducing the tax on an estate. Opinion on unified estate and gift tax credit exempt.

Tax Credits LLC is located at 45 Knightsbridge Rd Piscataway NJ 08854. The tax is then reduced by the available unified credit. RAccounting 1 hr.

This article is for the 2019 tax year. Or of course you can use the unified tax credit to do a little bit of both. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

The tax reform law doubled the BEA for tax-years 2018 through 2025.

2019 Key Tax Numbers For Individuals Eclectic Associates Inc

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

2019 Estate Planning Update Helsell Fetterman

Exploring The Estate Tax Part 1 Journal Of Accountancy

Here Are The 2020 Estate Tax Rates The Motley Fool

Foreign Estate Tax For Us Citizens Living Abroad

Msu Extension Montana State University

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

An Introduction To Taxation And Understanding The Federal Tax Law Ppt Download

2019 Estate Tax Rates The Motley Fool

Irs Guidance On Clawback Of Gift Estate Tax Exemption Cerity Partners

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Irs Announces Higher 2019 Estate And Gift Tax Limits

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Analyzing Biden S New American Families Plan Tax Proposal

Personal Finance Another Perspective Ppt Download

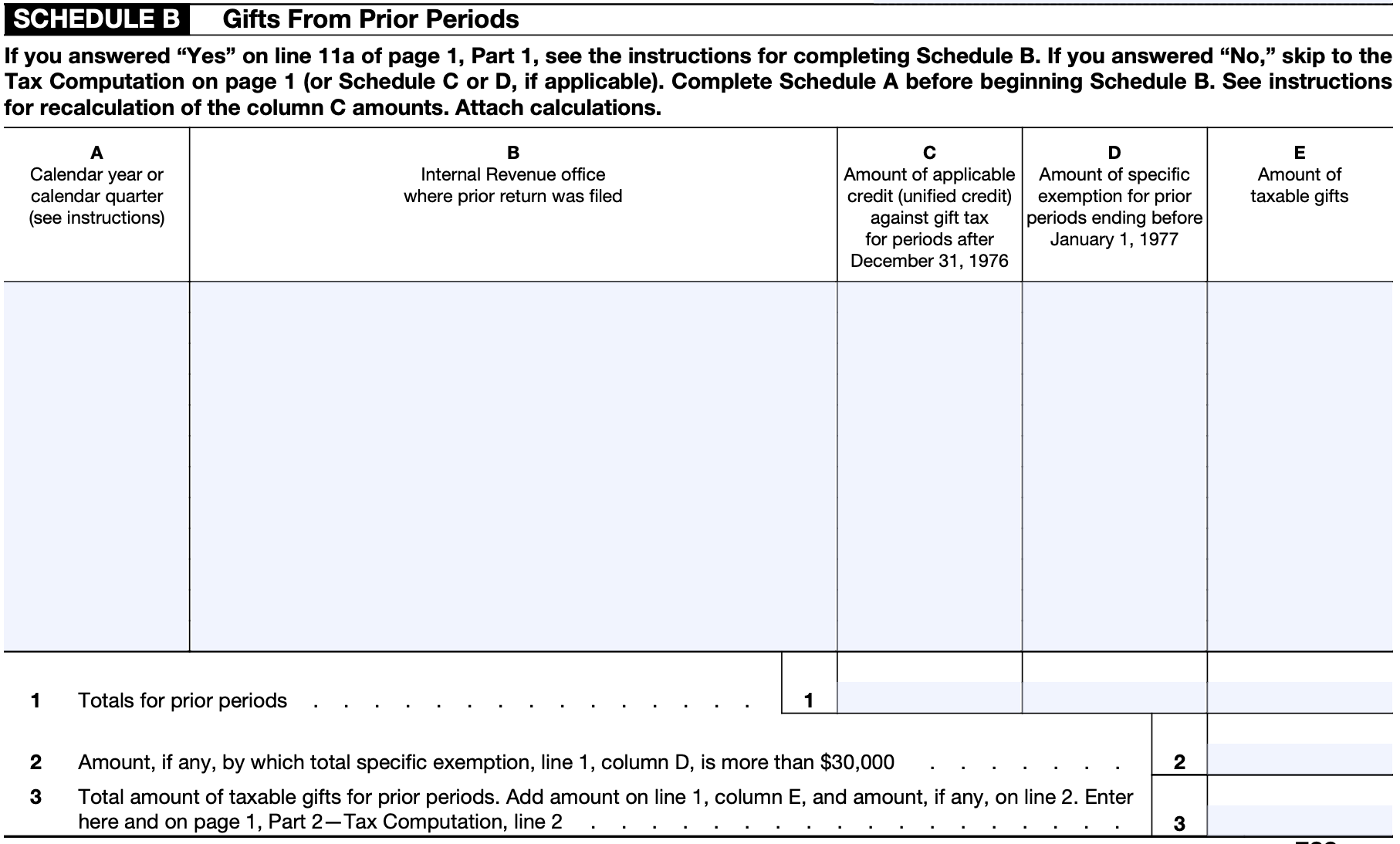

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset